What the Budget Means for Individuals, Businesses and SMSFs?

There are not so many changes for taxation and superannuation in this budget.

We have summarised the major measure relating to individual, business and SMSF taxpayers:

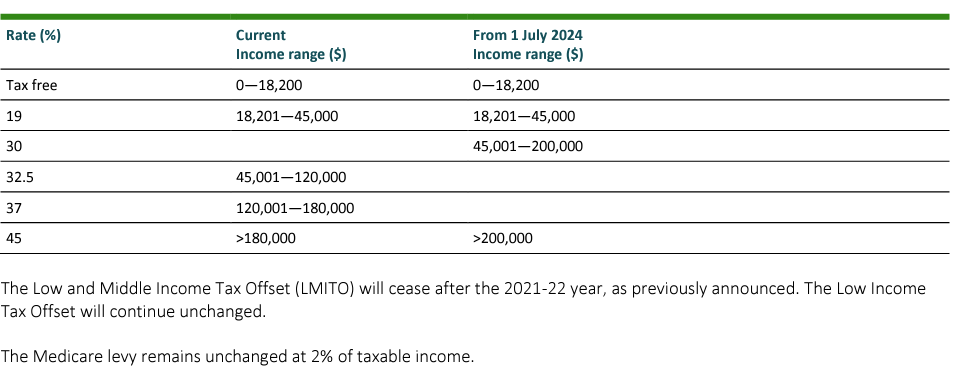

• Personal income tax rates: There are no changes to the Stage 3 tax cuts (already legislated to commence on 1 July 2024):

• Intangible assets depreciation – reversal of previously announced option to self-assess effective life for certain intangible assets (e.g., intellectual property and in-house software). The effective lives of such assets will continue to be set by statute.

• Digital currencies not a foreign currency – the Budget Papers confirm that the Government is to introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency.

• COVID grants treated as non-assessable non-exempt (NANE) income – the Budget Papers contain a listing of further State and Territory COVID-19 grant programs eligible for nonassessable, non-exempt treatment.

• Penalty unit increase – the Government will increase the amount of the Commonwealth penalty unit from $222 to $275 from 1 January 2023

• SMSF residency changes – the proposal to extend the central management and control (CM&C) test safe harbour from two to five years, and remove the active member test, will now start from the income year commencing on or after assent to the enabling legislation (previously 1 July 2022).

• SMSF audits every three years – the Government will not proceed with the former government’s proposal to allow a three-yearly audit cycle for SMSFs with a good compliance history.

• Downsizer contributions

The Government has confirmed the reduction in the eligibility age from 60 to 55 for Australians wishing to make downsizer contributions. Legislation to give effect to this measure is currently before the Senate.